Financial Weapons of Mass Destruction

“The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear. In my view, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.”

– Warren Buffett, Berkshire Hathaway 2002 annual report

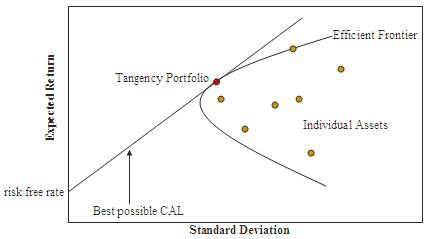

The recent GameStop surge cast harsh light on a new paradigm for retail investors. As you may know, derivatives are freely available in a retail setting, primarily due to the efforts of upstart brokers. While much has been written on the Robinhood business model, can we tease apart the outsized returns reported in mainstream media to better understand the nature of these financial WMDs? Of course, any discussion of derivative returns in a principled fashion must be understood via the Black-Scholes equation, which like Newtonian mechanics, is incorrect, but inherently useful. Further, derivatives can be registered in the canonical Capital Asset Pricing Model (CAPM) to determine it’s place in the efficient frontier1. The argument is that descriptive statistics (Sharpe ratio) apply to retail, technology, or innovation targeted portfolios, and derivatives add to the long tail from which black swan events lurk. Even in the general dominance of algorithmic fast trading, the classic long-short risk book has now a proven weakness towards intelligent agents.

Legendary Silicon Valley investor Michael Burry’s since deleted tweet

Legendary Silicon Valley investor Michael Burry’s since deleted tweet

The standard CAPM allows evaluation of the risk and return contribution of individual instruments to a risk optimal portfolio. In particular, it factors the variance or beta of the instrument with respect to its rate of return (less the risk free rate). A naive analysis of CAPM with regards to derivatives implies expansion of the efficient frontier (i.e. the linear combination of instruments that forms the rational basis for portfolio construction vis-a-vis risk management)1. Taken to its natural conclusion, the multiplication of financial instruments as the product of financial “engineering” increases the optionality of portfolio management. Cue the entrance of Buffett’s ominous warnings that stand as bellwethers if not of pure derivative arrangements then certainly prescient of the collateralized debt obligations causative of the 2008 financial crisis. Inspired by Buffett’s partner Charlie Munger’s homey entreaties, the consideration is when forbearance is warranted and where properly executed strategies may deliver outsized returns when interrogating market assumptions.

The modern approach as evidenced by hedge fund operations rests primarily on market assumption evaluation in context of CAPM and available instruments, derivatives being first approximation terms. For example, strategies that evaluate when the assumptions of CAPM and derivative pricing re: Black-Scholes is violate, structure is created to restore rationality and efficiency to market operation. Innovation investments must be structured in a principled fashion with regards to volatility and underlying distributions, i.e. the standard normal distribution assumption (i.i.d.) cannot necessarily be held as axiomatic. Evaluating probability distribution assumptions in a principled fashion is a sensible usage as opposed to naked directional methods inferring innovative action for which there is no causative agent created by the capital allocation. On the flip side, the contrapositive position of scraping the tail distribution for returns, as engaged by naked short sellers, has revealed to be the proverbial collecting returns before the steam roller.

By combing the insight of Buffett and Munger, we can evaluate the proper use of derivatives while not abandoning fundamental CAPM-based modeling and analysis. Metaphorically, it is only by turning derivative weapons to plowshares to axiomatically harvest return on the proper first and higher order approximations to tail risk do strategies find sustainable out-sized returns. Intelligent agents, with baked-in long tail Bayesian assumptions, act through reinforcement to seek black swans, transmuting them not to monsters, but unicorns of outsized returns.2

1 Derivatives and leverage to improve portfolio performance

2 For more details on financial intelligent agents

*This post is independent of Amicus.ai and do not necessarily reflect it’s views